Hongkongers not under pressure to sell property to repay loans even though household debt is at record high, analysts say

- Hong Kong’s household debt-to-GDP ratio rose to a record 90.2 per cent as of the end of 2020, compared with 80.4 per cent a year earlier

- Panic selling seen during Sars crisis won’t be repeated, mReferral chief vice-president says

Analysts have played down any pressure on Hongkongers to sell their properties to repay loans after household debt hit a record high last year.

“There was panic selling in the last health crisis in 2003, but it will not be repeated this time, even where household debts are high,” said Eric Tso, chief vice-president at mReferral Mortgage Brokerage Services.

Following a year of economic devastation caused by the Covid-19 pandemic, Hong Kong’s household debt-to-gross domestic product (GDP) ratio rose to a record 90.2 per cent as of the end of 2020, compared with 80.4 per cent a year earlier, according to a report released by the Hong Kong Monetary Authority (HKMA) last month. A decade ago, the ratio only stood at about 50 per cent.

Of this debt, mortgages made up a major component, representing 68 per cent of the total. Total outstanding mortgages stood at HK$1.59 trillion (US$204.4 billion) as of the end of February this year, with most families spending about half of their incomes to repay these loans.

Currently, however, interest rates are at a record low level, with mortgage interest rates hovering just above 1 per cent compared with the more than 11 per cent in 1998, said mReferral’s Tso.

“In the face of the pandemic, Bank of China Hong Kong has taken the lead in launching a series of financial support and relief initiatives,” a bank spokeswoman said. The lender is allowing mortgage borrowers to apply for mortgage repayment holiday until October this year.

The number of owners with negative equity – when the value of a property falls below the outstanding balance of the mortgage used to purchase it – also stood at only 185 currently, compared with a peak of 106,000 in June 2003, said Derek Lai Kar-yan, vice-chairman of Deloitte China.

HKMA, the city’s de facto central bank, has also played down any worries around high household debt.

Hong Kong home mortgages expected to drop to four-year low in 2020

A major reason for the high ratio was Hong Kong’s worst recession on record. The city’s economy contracted by 6.1 per cent last year, so loan growth was not really that high, Edmond Lau Ying-pan, the authority’s deputy chief executive, said in an article last month.

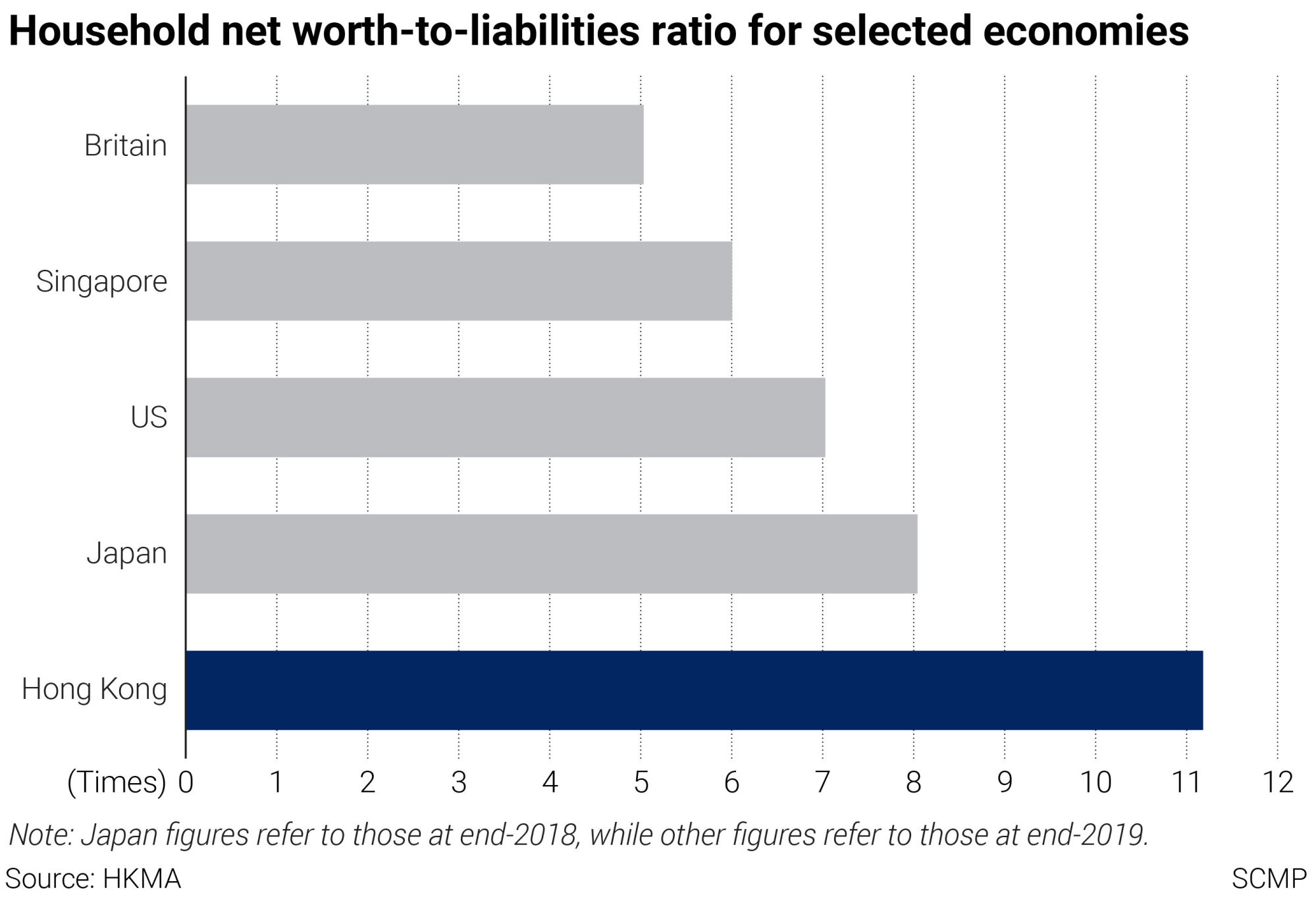

He said residential mortgages had grown by 1.6 times since 2009 until the end of last year, slower than a 2.5 times increase in property prices. Most importantly, while Hong Kong households’ debt had increased, so had their wealth. The city’s household net worth-to-liabilities ratio remained high at 11.2 times in 2019, much better off than households in Britain, where the ratio stood at five times, the United States, where it stood at seven times, and Japan, where it stood at eight times, Lau said.

“We consider that the credit quality of local household debt has held up well and the overall financial position of the household sector remains robust,” Lau said.

Thousands of Hongkongers face home financing crunch as flat delivery increases and banks tighten loan scrutiny amid economic slump

The number of multimillionaires in Hong Kong, defined as those with HK$10 million each in total assets, hit a record high of 515,000 last year, up from 413,000 in 2019, according to a Citibank survey.

And people with disposable incomes were still buying property, said analysts. Some said they expected home prices to rise by about 5 per cent this year.

“We have seen many new property projects sell out quickly. It is expected that property prices will go up by another 5 per cent this year. Many people still have the ability to buy [real estate],” said mReferral’s Tso.