China’s FDI inflows surge at fastest rate in 13 years during first quarter, surpassing pre-pandemic level

- 10,263 new foreign-invested companies were established in China during the first three months of the year

- Data from the Ministry of Commerce comes as China continues to court foreign businesses while the United States is looking to help American companies exit the Chinese market

Foreign direct investment in China grew at the fastest pace in more than a decade during the first quarter of 2021, according to data released by the Ministry of Commerce on Thursday.

Foreign direct investment – excluding financial sectors such as banking, securities and insurance – surged 43.8 per cent during the January-March period, year on year. That was the highest quarterly growth rate since the second quarter of 2008.

In yuan terms, FDI in the first quarter grew by 39.9 per cent to 302.47 billion yuan (US$46.28 billion), marking a 24.8 per cent increase from the same period in pre-coronavirus 2019.

A total of 10,263 new foreign-invested companies were established in China during the first three months of the year, 47.8 per cent more than during the first quarter of 2020, and a 6.8 per cent increase from the same period in 2019, ministry data shows.

China’s state-led economy makes it clear for foreign firms: you’re either OK with regulatory requirements, or you’re out

“Maintaining the security of the global industrial chain and supply chain is in the interests of China, the US and the whole world,” Gao Feng, spokesman for the commerce ministry, said at a press conference on Thursday.

He also said that US-China trade saw robust growth in the first quarter, since the world’s two largest economies were both recovering rapidly from the economic impact of the pandemic.

“The economic and trade structures of the two sides are highly complementary, and there is huge potential for cooperation,” he said.

On top of the strong trade data released on Tuesday, the surge in FDI also pointed to a record-high growth in China’s gross domestic product (GDP) during the first quarter. The GDP figure is due to be released on Friday.

The new investment data also indicates that the pandemic has brought China closer to its trading partners under the umbrella of its Belt and Road Initiative, particularly countries in Southeast Asia.

Belt and Road countries invested US$3.25 billion in China during the first quarter – a 64.6 per cent increase, year on year. And 1,241 new companies from those countries were established in China – up 44 per cent over the first three months of last year. Meanwhile, the value of China’s outbound direct investment into Belt and Road countries rose 5.2 per cent to US$4.42 billion.

China defends its US$944 million loan to Montenegro for motorway project

Data also shows that FDI into China’s hi-tech industries rose 32.1 per cent in yuan terms during the first three months of the year, with a jump of 43.9 per cent in the hi-tech service sector and a rise of 2.5 per cent in hi-tech manufacturing.

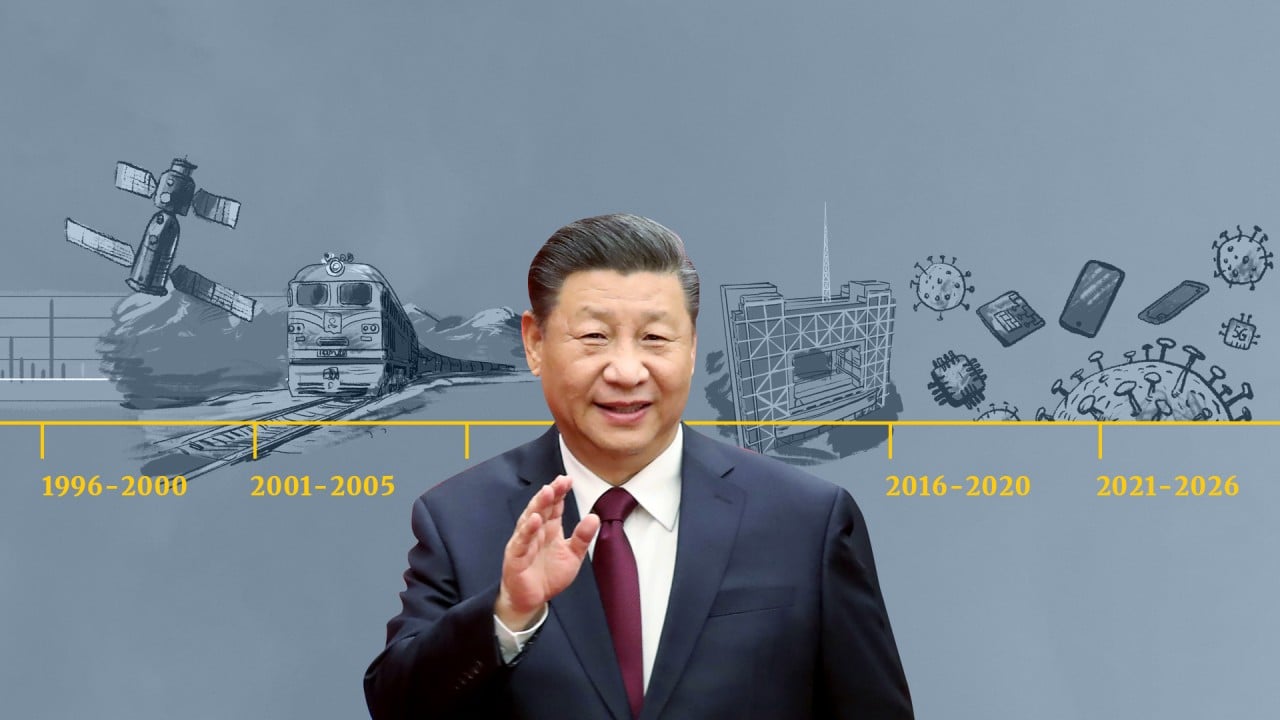

This came after Beijing outlined a comprehensive five-year plan for 2021-25 to upgrade its manufacturing capabilities in eight critical areas, including robotics, aircraft engines, new energy vehicles and smart cars.

Additionally, FDI into the service sector was 237.79 billion yuan in the first quarter, up 51.5 per cent.

In yuan terms, the total FDI that flew into eastern, central and western China increased by 38.2 per cent, 36.8 per cent and 91 per cent, respectively.